Home >

Corporate News >

NMS’s Overseas Business Shows Significant Growth in H1 2024 Operational Data Continues to Improve

Home >

Corporate News >

NMS’s Overseas Business Shows Significant Growth in H1 2024 Operational Data Continues to Improve

2024.08.27

2024.08.27

In the first half of 2024, Nanchang Mineral Systems Co., Ltd. (hereinafter to as “NMS”) achieved a revenue of 419 million RMB, demonstrating a solid market foundation and sustained growth momentum. Over the past three years, NMS has achieved a compound annual growth rate of 5.58%, reflecting the company’s steady development and strong market adaptability. During this period, thanks to the company’s excellent cost control measures and enhanced profitability, the gross profit margin remained high at 33.83%, with a net profit of 51.6573 million RMB.

Breakthrough Growth in Overseas Business; International Strategy Yields Remarkable Results

In the first half of the year, NMS’s overseas business made breakthrough progress, with overseas revenue reaching 42.1959 million RMB, marking a year-on-year growth rate of 370.23%. This remarkable increase signifies the deep implementation and successful execution of the company’s international strategy. Additionally, the proportion of overseas revenue increased significantly from 1.94% in the same period last year to 10.07%, laying a solid foundation for the company’s future global expansion. Against the backdrop of a gradual global economic recovery and sustained demand for metal minerals, NMS is actively planning and intensifying its presence in overseas metal mining markets. Through strategic initiatives such as establishing spare parts warehouses and evaluating the setup of manufacturing bases, NMS is enhancing its global competitiveness and serving local markets in a more direct and efficient manner.

Significant Improvement in Operating Cash Flow

NMS’s net cash flow from operating activities improved significantly, rising from -58 million RMB in the same period last year to -13 million RMB. This positive trend is attributable to the company’s ongoing cost reduction and efficiency enhancement measures, as well as effective cash management strategies. The positive shift in cash flow provides a stronger financial foundation for the company’s future investments, expansions, and ability to respond to market changes, further enhancing its financial health.

Continued Optimization of Period Expenses and Debt-to-Asset Ratio

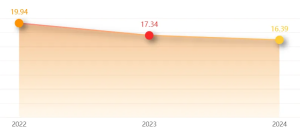

NMS places great importance on operational efficiency and cost control. Through a series of refined management measures, the period expense ratio was reduced from 17.34% in the same period last year to 16.39%, effectively enhancing overall profitability. At the same time, the company’s debt-to-asset ratio decreased from 35.46% last year to 29.84%.

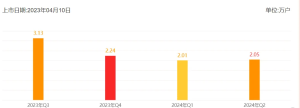

Decrease in Number of Shareholders; Increased Concentration of Shares

Future Outlook: Paving the Way for New Developments

Looking ahead, NMS will continue to uphold its business philosophy of “professional leadership, integrity first, and altruistic management,” actively expanding market channels, deepening its presence in international markets, and striving to increase the global market share of its products. Simultaneously, the company will continue to optimize its product structure and improve the level of refined management, aiming to further enhance its gross profit margin while maintaining its stability, thereby creating more substantial returns for shareholders. In the overseas market, NMS will focus on key regions such as Africa, Australia, and North America. Through initiatives like setting up spare parts warehouses, building logistics and distribution systems, and exploring new business models following Chinese enterprises abroad, the company aims to drive continuous growth and expansion in the overseas market.